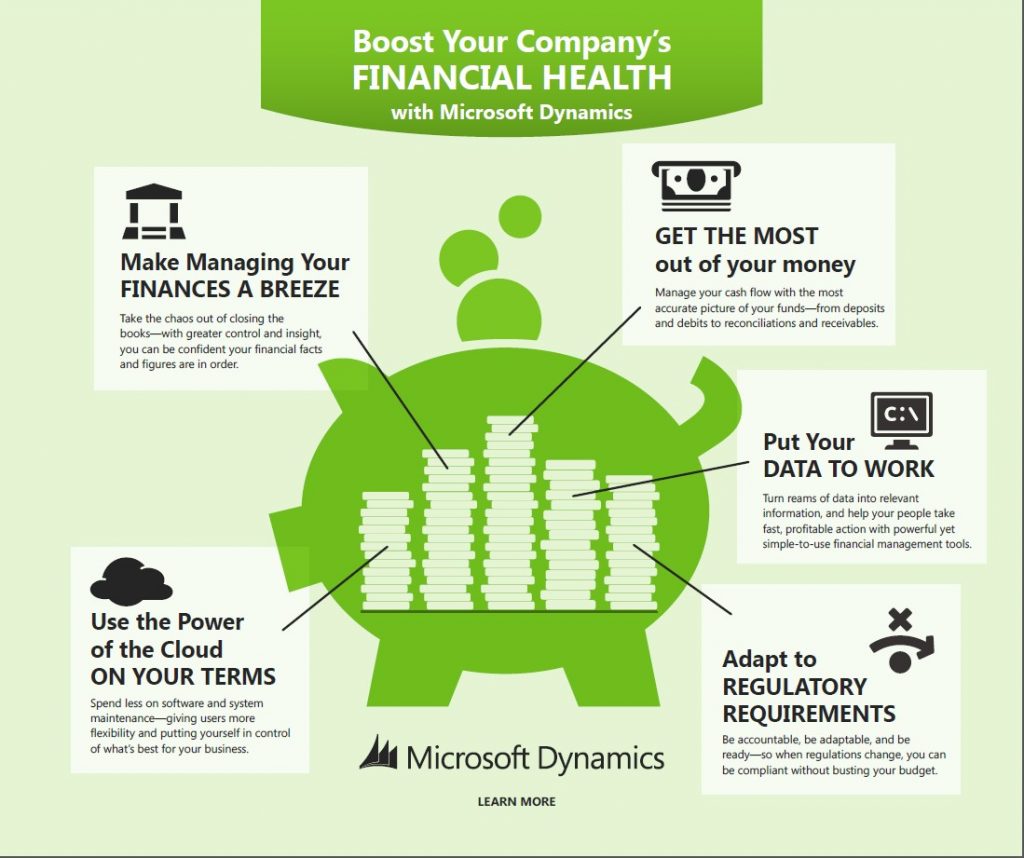

Five Tips to Boost Your Company’s Financial Health Part 1: Make Managing Your Finances a Breeze

We’re all a little tight with the purse strings these days, and when it’s your job to keep a close eye on the financial comings and goings of your company, you want to make sure your systems reflect the most accurate information available. In this five-part blog series, “Five Tips to Boost Your Company’s Financial Health,” we’ll show you how access to the right tools and the right information improves everyone’s performance, how you can use data to make better decisions for your business, how to better manage your cash flow, how shifting systems to the cloud can reduce your costs and how the right systems can help you manage compliance and reduce your risk. Read on, and you’ll see.

Make Managing Your Finances a Breeze

If you know what’s good for you, you stay away from the accounting department at the end of the month. Things get a little hectic in there, and all they can focus on is running the balance sheet and closing the books. If you know what’s good for your business, you’ll give them (and all your employees) the tools they need to work smarter and more efficiently.

Think about it. How much time goes into closing your books each month? How accurate do you feel your financials and budgets really are? How confident are you when you make business decisions based on that information? And most importantly, how much better could your business performance be if you had accurate, immediate, relevant information to work with?

These are big questions for any company, and a business solution from Microsoft provides the answers—giving everyone in your organization access to the data most relevant to their roles. From your desk to the front desk and yes, the accounting department, your people get personalized information they can really use to improve their daily work, rather than chasing numbers and juggling tasks. The best part? It’s delivered via role-tailored home pages, easy-to-use dashboards and Microsoft Office tools they already know. Armed with the visibility, accuracy and insight these types of flexible financial management tools provide, your people can focus on today, tomorrow and your company’s future, not simply on getting through the end of the month.

See how Shock Doctor reduced the time required for month-end closing by 50 percent and recovered up to 400 hours per year in time spent processing transactions with the help of Microsoft Dynamics ERP.

Join us next week and find out how to get your data to do more than accumulate. Until then, register for the upcoming webcast: 5 Steps to Better Financial Management and Improved Cash Flow or learn more about Microsoft Dynamics ERP.