Win new customers – and keep them – in the world of digital banking

It’s no secret that today’s sales landscape is changing across all industries. There’s more information at people’s fingertips, savvier buyers, and an abundance of options. In fact, it costs five times more to attract a new customer than it does to keep an existing one satisfied.[1]

Pressure on sellers has also intensified as they struggle to find time for meaningful engagements. Internal demands consume more than 67% of a salesperson’s time, leaving them with little room for selling.

The banking industry is not immune to this tremendous pressure. Banks must find ways to decrease the seller burden while building meaningful customer engagements. Three tactics are key for banks to not only achieve this but also stay ahead of the curve: (1) accelerate lead management with machine learning, (2) optimize the sales process through collaboration and automation, and (3) make intelligent, personal recommendations.

Land leads fast with machine learning

Land leads fast with machine learning

Accelerating lead management is not a new objective, but new technology can streamline the process even further. Using machine learning algorithms, banks can find meaningful patterns in copious amounts of data at high speeds—something a person could never do. Applying this technology to the lead management process, banks can not only determine the value of each lead, but also automatically generate and prioritize them. Sellers can now act quickly, knowing who to focus on and the next best action to take.

The benefits of machine learning go beyond creating a more proactive sales pipeline. Armed with meaningful intelligence, sellers can easily engage customers with relevant offers across all channels. For example, by engaging in social selling, banks can analyze buying signals in social posts and easily share relevant content with prospective customers—differentiating them from competitors and accelerating customer acquisition.

Optimize sales through collaboration

Optimize sales through collaboration

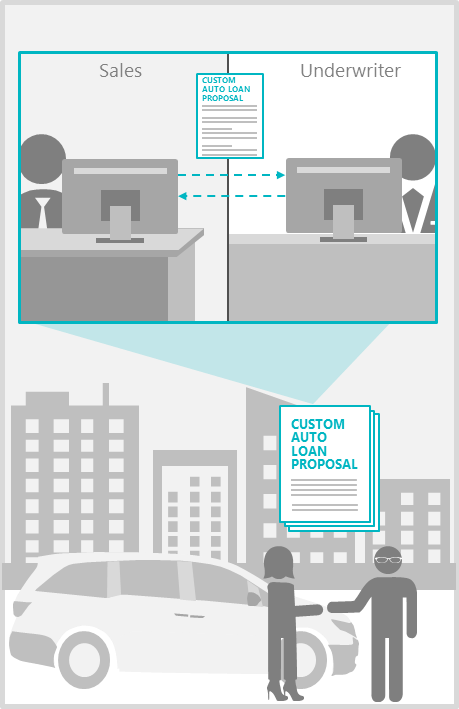

Companies that prioritize collaboration are twice as likely to be profitable and twice as likely to outgrow competitors.[2] Imagine the efficiencies gained when employees in different departments can simultaneously edit documents in real-time and share conversations, events, notes, and pictures. Drawing from the collective wisdom of their peers, sellers can spend less time creating offers and more time selling, increasing conversion rates by up to 60%.[3]

For example, based on PMR Consulting research, by automating manual operational processes in the loan cycle, such as document review, data entry, and collaboration with third parties, loan processors saw a 30% increase and closers a 50% increase in productivity. With less time spent on manual tasks, employees are free to spend time with customers, driving business results that matter.

Use machine learning to keep banking personal

Use machine learning to keep banking personal

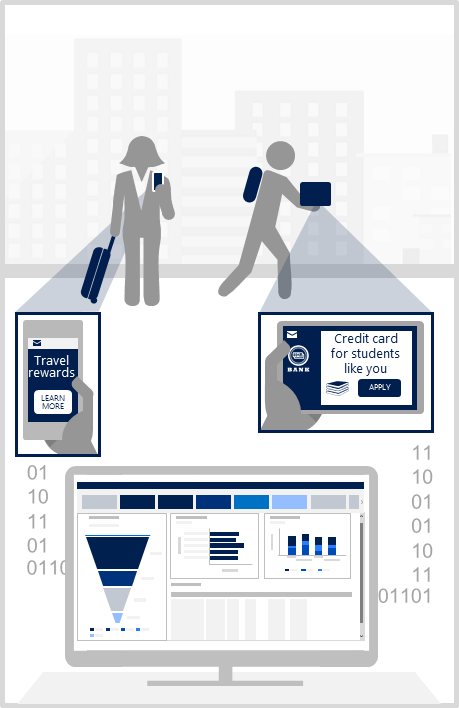

With only 31% of consumers believing their financial institutions know them and their needs well, it’s clear that personalization has moved from nice-to-have to a necessity.[4]

Once again, machine learning technology is a game changer. Leveraging predictive algorithms, banks can determine what customers will most likely want and generate recommendations that suit their needs. For example, based on a customer’s travel-related purchases or current life stage, a bank could offer tailored recommendations like a travel rewards program or a new credit card.

A centralized customer view gives machine learning the data it needs to create valuable predictions. For example, a large Saudi investment bank knew it needed to change its slow, manual processes to please dissatisfied customers. Implementing a centralized view of customer data empowered employees with the information necessary to tailor their recommendations. Applying machine learning-driven predictions to this data automatically surfaced personalized offers.[5]

Personalization is the key to successful selling

Despite the challenges in today’s sales landscape, banks are beating out the competition by using streamlined, personalized approaches. By streamlining lead management, optimizing operations across all channels, and utilizing machine learning to drive personalization, employees can create meaningful recommendations that make customers feel truly valued.

Microsoft Dynamics 365 empowers banks to drive personal, proactive engagement with customers. Through powerful, intelligent business applications, banks can build qualified pipelines using actionable insights, engage customers proficiently with predictive intelligence, and increase productivity through content collaboration. Dynamics 365 doesn’t just enhance the sales process, it enables banks to deliver intelligent, effortless customer service that naturally supports the needs of each customer.

Learn how Dynamics 365 can help you transform your sales approach