Transform your finance operations and drive innovation with Dynamics 365

Over the past twenty-five years, there’s been a dramatic shift both in the role that technology plays in most businesses, as well as how it’s managed. While technology spending was once primarily consolidated in the IT department, today’s technology budgets are generally distributed across the entire organization. In fact, an early 2018 IDG survey found that only 54 percent of technology investments are actually controlled by IT departments. With software and analytics solutions making up an increasing percentage of technology spend, the average CMO now wields as much technology spending power as a CIO.

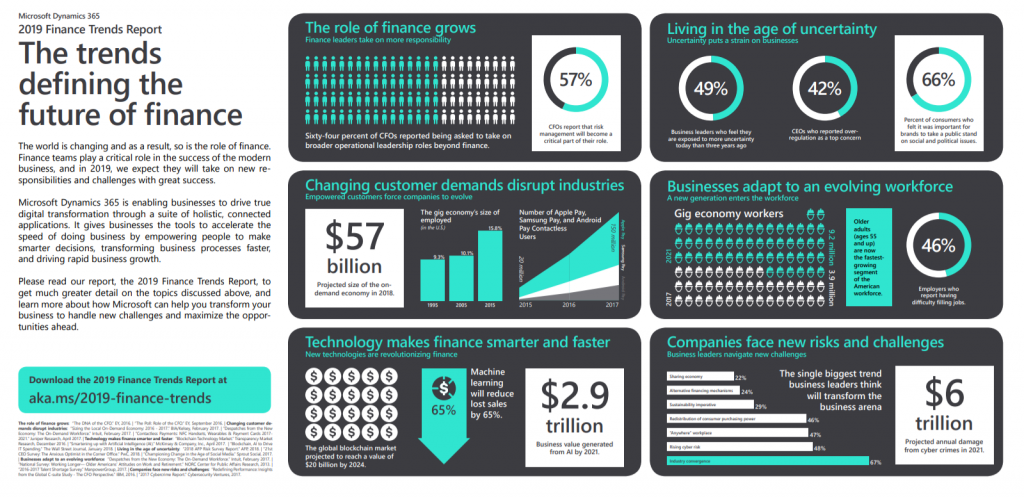

As a result, CFOs increasingly find themselves overseeing tech spending across the business. As technology becomes a critical component in the financial success of an organization, finance departments have taken a more significant role in managing technology, particularly in the areas of risk management and investment.

Why CFOs are leading the tech revolution

It’s clear that technology is now more than just a number on a balance sheet, it’s the lifeblood of many organizations, presenting revenue opportunities that will determine the future of the business. This is clear when you consider the number of companies that have transformed their business models using Anything as a Service (XaaS) offerings and on-demand services (up 7.3 percent in 2017).

Today, many CFOs find themselves playing the role of transformation leader, evaluating technology investments, overseeing product development, and leading strategic planning for the organization. According to a recent survey by Grant Thornton, nearly 70 percent of CFOs reported plans to increase investment in digital transformation in 2018, with 40 percent planning an increase of more than 10 percent. And with 56 percent of senior leadership identifying digital transformation as critical to long-term success, CFOs’ involvement in this area will continue to grow.

High-tech high wire act: balancing financial risk and reward

This transformation comes at a cost: as technology becomes increasingly foundational to how companies operate, senior leadership must contend with a host of new risks, including technology failures and data breaches. Beyond the many unquantifiable costs to a data breach—from customer trust to employee morale—the direct financial cost of a technology failure is significant. In 2017, the average cost of a data breach was $3.62 million, and with an average cost of $141 per lost or stolen record, this number escalates quickly for large businesses. As a result, finance leaders are taking on greater responsibility in helping their businesses better manage this large financial risk; fifty-seven percent of CFOs report that risk management will become a critical part of their role in the future, a number that jumps to 66 percent among CFOs of companies with over $5 billion in revenue.

Dynamics 365 in action

WE, the international charity organization that empowers kids, families, and schools to make a positive contribution to their communities, recently rebooted its technology systems with Microsoft’s Power BI, Dynamics 365 for Finance and Operations, and Skype for Business. “The process has resulted in more than simply saving employees’ time,” (and the headache of tracking down an errant spreadsheet), said Russ McLeod, Executive Director of Social Enterprise at WE. “Digital transformation is helping us decrease the cost to impact an individual life through our work at WE,” he explained. “This technology helps us maximize our impact.”

“We understood the foundation of future success was getting our finances right, so switching to Dynamics was a clear priority at the outset of WE’s digital transformation strategy,” said McLeod. Dynamics collects data from the top to the bottom of WE so employees can get detailed, granular insights into departments within the organization. “Now for the first time, my models produce insights into each division’s profitability—because of Dynamics,” he said.

WE leadership can now make data-driven decisions about their long-term growth strategy. “With annual planning, now we can model how our decisions will affect our margins, our bottom line, and our ability to donate to our charity,” McLeod explained. “Once we identified where we were most impactful and efficient in delivering results, the question of where to invest resources for maximum impact became clearer.”

When WE can quantify exactly how much they need to, say, get a young workforce-ready, donors and funders recognize the value. “Once we have that clarity through Dynamics, we have an incredible development tool,” said McLeod. “Showing WE’s high impact areas through hard numbers demonstrates why people should invest in us.”

How Microsoft is helping finance leaders transform their operations

From the intelligent analytics of Power BI and the AI capabilities of Azure to the suite of holistic, connected applications offered by Microsoft Dynamics 365, Microsoft powers intelligent finance operations. Microsoft can help you increase the speed at which your organization does business by empowering employees to make smarter decisions, accelerate process transformation, and drive business growth. For more information on how technology is driving innovation in finance, read Microsoft’s 2019 Finance Trends Report.