Dynamics 365 for Finance & Operations, December service update – Now Generally Available!

Across the globe, ever-changing competitive and regulatory landscapes demand that businesses move quickly to respond and thrive. At Microsoft, we’re committed to helping our customers achieve digital transformation outcomes that foster continued innovation and help capture new business opportunities.

I’m pleased to share highlights from the recent updates to Dynamics 365 for Finance and Operations that address reporting, efficiency, and global compliance issues with modern, intelligent, and adaptable solutions.

Enhanced Financial and Operational Reporting – The latest service release introduces a new set of default reports built using Power BI. The  new financial reporting experience is now embedded within the Dynamics 365 UX, giving users a seamless experience of report generation and allowing them to drill into supporting documents. Key subledger data is available to provide better ledger to subledger analysis. Default reports such as a trial balance, balance sheet, and profit and loss, are shipped out of the box and can be quickly and easily customized using the Power BI desktop. The existing financial reporting using Report Designer is still available and fully supported.

new financial reporting experience is now embedded within the Dynamics 365 UX, giving users a seamless experience of report generation and allowing them to drill into supporting documents. Key subledger data is available to provide better ledger to subledger analysis. Default reports such as a trial balance, balance sheet, and profit and loss, are shipped out of the box and can be quickly and easily customized using the Power BI desktop. The existing financial reporting using Report Designer is still available and fully supported.

In addition, Power BI Solution Templates are now available on AppSource. These will empower our customers to extend our existing Power BI reports for unique business requirements.

Global Coverage – India Regulatory Functionality. In this update we’ve added and updated important regulatory functionalities for India, where a new Goods and Services Tax (GST) is driving sweeping business changes and a strong move to the cloud. Dynamics 365’s strong international accounting, tax, and operations capabilities along with Microsoft’s strong local presence make Microsoft a natural choice for businesses seeking a digital transformation partner. Fixed asset depreciation, Value-added tax (VAT), Withholding tax, Custom Duty and India GST are all supported, with additional Retail regulatory functionality currently in public preview. Customers and partners can easily configure India GST in the Global Tax Engine without the painful application changes required by many other systems.

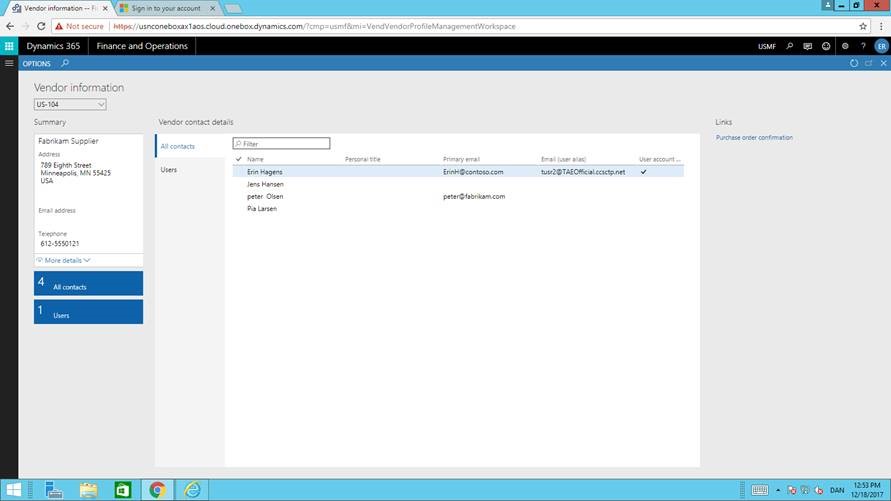

Vendor Collaboration – A new vendor portal provides vendors with self-service capabilities to view and selectively maintain their own  company information, such as contact information, business identification data, procurement categories, and certifications. We also enhanced vendor onboarding with a new workflow-supported process which can facilitate the addition of new vendors using invite-based registration and signup, further improving employee productivity. In addition to onboarding and profile maintenance, we included support for vendors to view and respond to RFQs with the ability to receive and upload attachments. The collaborative interface allows the vendor to receive information about the awarded or lost bids. In public sector configurations, RFQs can now be published and exported as entities via data management. This enables the data to be consumed and exposed in a customer-hosted public website.

company information, such as contact information, business identification data, procurement categories, and certifications. We also enhanced vendor onboarding with a new workflow-supported process which can facilitate the addition of new vendors using invite-based registration and signup, further improving employee productivity. In addition to onboarding and profile maintenance, we included support for vendors to view and respond to RFQs with the ability to receive and upload attachments. The collaborative interface allows the vendor to receive information about the awarded or lost bids. In public sector configurations, RFQs can now be published and exported as entities via data management. This enables the data to be consumed and exposed in a customer-hosted public website.

End-to-End Process Integration – In July, Microsoft introduced Prospect to Cash integration, leveraging the Microsoft Common Data Service (CDS) to enable deeper business processes integration across Dynamics 365 applications and thereby transform operations. With our latest update, companies can now maintain data synchronization of processes between Dynamics 365 for Sales and Dynamics 365 for Finance and Operations using data integration templates without a third-party data integration tool. These enhancements enable additional end-to-end business process integrations focusing on customer, quote, sales order, invoice, and order fulfillment data. More information about the supported processes integration scenarios can be found here.

Implementation efficiency – To further improve the implementation experience for our customers we’ve enabled a new capability to create legal entities based on configuration data from an existing legal entity, drastically shorten setup time for new legal entities. In addition, we continue to make progress towards a full extension-based customization model to improve serviceability. In this release we’ve enabled a ‘soft-seal’ mode for the application functionality, which will help customers and partners to recognize un-desirable customization development patterns as warnings during compilation. We recommend using only the extensions approach to customize using the pre-defined extensible points and we have enabled ability to request new extension support easily, should it be necessary.

These examples above represent just a few of the highlights of the December service update for Dynamics 365 for Finance and Operations (application version 7.3). Detailed overview of all updates can be found here in our online documentation.

To stay up to date on the new capabilities we have shipped for any of our Dynamics 365 application, make sure you visit the “What’s New” section of our public roadmap and our Dynamics 365 product documentation portal.

Your feedback matters! Our products and services get better with your continued use and guidance. Please continue to submit product ideas by using the Dynamics 365 ideas portal and check back to see what other users are proposing or voting on.