Boost your ecommerce revenue with Dynamics 365 Fraud Protection

With the booming growth of online technologies and marketplaces comes the burgeoning rise of a variety of cybersecurity challenges for businesses that conduct any aspect of their operations through online software and the Internet. Fraud is one of the most pervasive trends of the modern online marketplace, and continues to be a consistent, invasive issue for all businesses.

As the rate of payment fraud continues to rise, especially in retail ecommerce where the liability lies with the merchant, so does the amount companies spend each year to combat and secure themselves against it. Fraud and wrongful rejections already significantly impact merchants’ bottom-line in a booming economy and as well as when the economy is soft.

The impact of outdated fraud detection tools and false alarms

Customers, merchants, and banking institutions have been impacted for years by suboptimal experiences, increased operational expenses, wrongful rejections, and reduced revenue. To combat these negative business impacts, companies have been implementing layered solutions. For example, merchant risk managers are bogged down with manual reviews and analysis of their own local 30/60/90-day historical data. These narrow, outdated views of data provide a partial hindsight view of fraud trends, leaving risk managers with no real-time information to work with when creating new rules to hopefully minimize fraud loss.

One of the most common ways that fraud impacts everyday consumers and business is through wrongful rejections. For example, when a merchant maintains an outdated and/or strict set of transaction rules and algorithms, a customer who initiates a retail ecommerce transaction through a credit card might experience a wrongful rejection known to consumers as a declined transaction, because of these outdated rules. Similarly, wrongful declined transactions can also happen when the card issuing bank refuses to authorize the purchase using the card due to suspicion of fraud. The implications of these suboptimal experiences for all parties involved (customers, merchants, and banks) directly correlates into loss of credibility, security, and business revenue.

Introducing Microsoft Dynamics 365 Fraud Protection

As one of the biggest technology organizations in the world, Microsoft saw an opportunity to provide software as a service that effectively and visibly helps reduce the rate and pervasiveness of fraud while simultaneously helping to reduce wrongful declined transactions and improving customer experience. Microsoft Dynamics 365 Fraud Protection is a cloud-based solution merchants can use in real-time to help lower their costs related to combatting fraud, help increase their revenue by improving acceptance of legitimate transactions, reduce friction in customer experience, and integrate easily into their existing order management system and payment stack. This solution offers a global level of fraud insights using data sets from participating merchants that are processed with real-time machine learning to detect and mitigate evolving fraud schemes in a timely manner.

Microsoft Dynamics 365 Fraud Protection houses five powerful capabilities designed to capitalize on the power of machine learning to provide merchants with an innovative fraud protection solution:

- Adaptive AI technology continuously learns and adapts from patterns and trends and will equip fraud managers with the tools and data they need to make informed decisions on how to optimize their fraud controls.

- A fraud protection network maintains up-to-date connected data that provides a global view of fraud activity and maintains the security of merchants’ confidential information and shoppers’ privacy.

- Transaction acceptance booster shares transactional trust knowledge with issuing banks to help boost authorization rates.

- Customer escalation support provides detailed risk insights about each transaction to help improve merchants’ customer support experience.

- Account creation protection monitors account creation, helps minimize abuse and automated attacks on customer accounts, and helps to avoid incurring losses due to fraudulent accounts

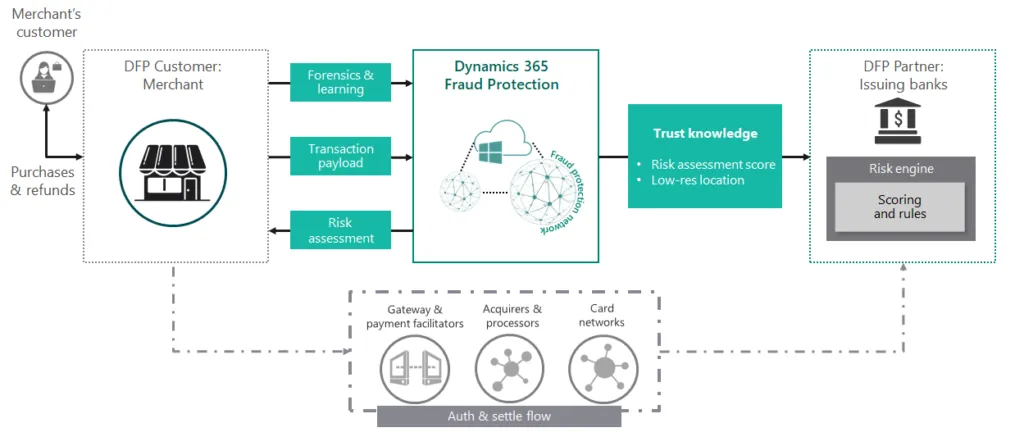

See the image below to learn more about the relationship between merchants and banks when they both use Dynamics 365 Fraud Protection:

Banks worldwide can choose to participate in the Dynamics 365 Fraud Protection transaction acceptance booster feature to increase acceptance rates of legitimate authorization requests from online merchants using Dynamics 365 Fraud Protection. Merchants using the product can opt to use this feature to increase acceptance rates for authorization requests made to banks without having to make any changes to their existing authorization process.

Learn more

This week at Sibos 2019 in London, Microsoft will be showcasing its secure and compliant cloud solutions for the banking industry. Read a round-up of announcements unveiled at Sibos and view an agenda of Microsoft events and sessions at the show. Stop by our booth (Z131) for a showcase of applications relevant to banking, including Microsoft Dynamics 365 Fraud Protection, which will be generally available on October 1st, 2019. Contact your Microsoft representative to get started.