Setup for sales tax which should be used when ‘Price include sales tax’ is enabled on a Store

Hello,

If you have any issues regarding sales tax (net amount) rounding between Retail store transactions and posted sales invoice voucher transactions, you should check at first Sales tax setup.

The recommended setup for sales tax which should be used when ‘Price include sales tax’ is enabled on a Store.

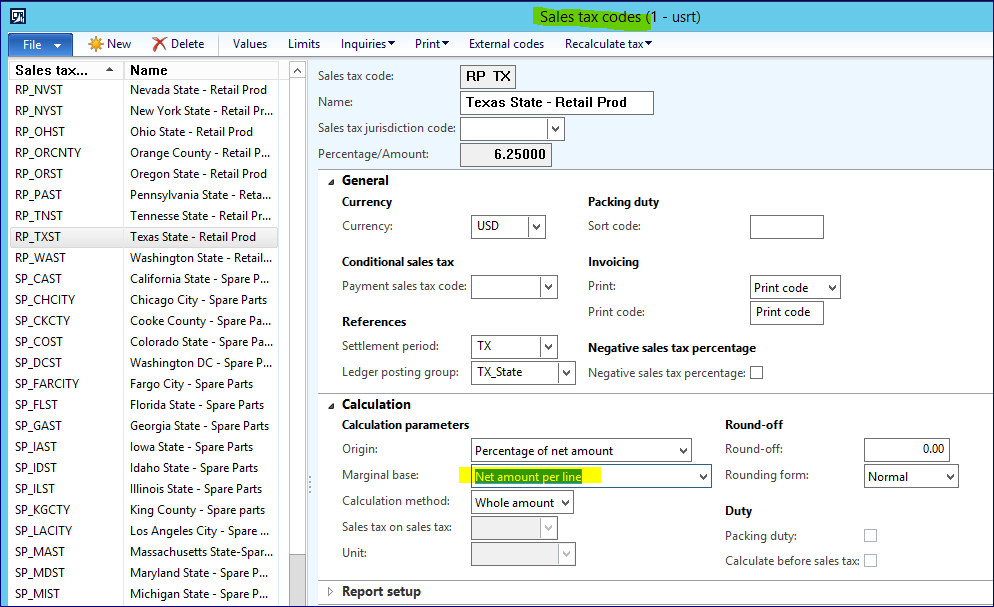

- ‘Marginal base’ to set up as ‘Net amount per line’ for Sales tax code:

Tab Calculation:

- Origin= Percentage of net amount

- Marginal base= Net amount per line

- Calculation method= Whole amount

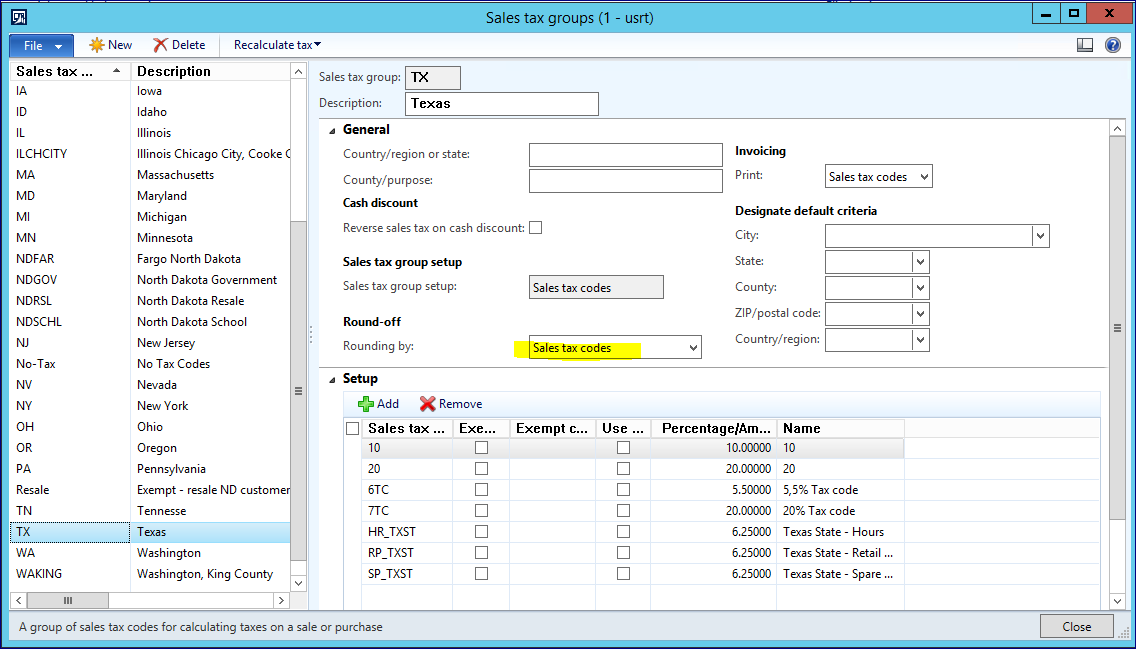

2. ‘Rounding by’ recommended to have ‘Sales tax codes’ for Sales tax group:

It is very important to know that once you did some changes on sales tax setup in HQ, you should run Job 1080 (Tax) and then be sure that Retail server is restarted, because changed tax setup might be cached (for immediate affect, otherwise Retail Server pool is refreshed in 30 min).

With that setup you should always get the same calculation of all amounts (Net amount and Sales tax amount) in POS/Retail and in HQ transactions.

Also a suggestion to change sales tax setup only after working hours when nobody is working to be sure that the changes are done correctly, distributed to POS and there are no differences between HQ and POS or their transactions.

The same is valid for AX2012 and D365.

Best regards,

Ramune Peckyte

Microsoft EMEA Customer Services and Support