Microsoft Dynamics AX – 1099 Tax update details for 2014

There have been several requests for more detailed information about what changes were introduced in this year’s 1099 update packaged in hotfix KB3019585. Here is an outline of the changes that we have made.

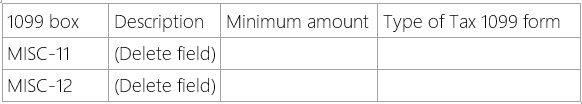

1099-MISC

1. Boxes 11 Foreign tax paid was deleted but box remains as shaded blank box on form

2. Boxes 12 Foreign country or U.S. possession was deleted but box remains as shaded blank box on form.

3. Update 1099 fields

4. Modify code to no longer enter data into MISC-12

a. Vendors with 1099 box set to MISC-11 will have 1099 box set to blank

5. Upgrade 1099-MISC transactions dated 1/1/2014 and forward for the following

a. Transactions with box MISC-11 must have the 1099 box set to blank

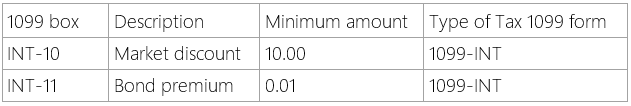

1099-INT

1. Height for Boxes 4 and 5 was decreased from 4 lines to 3 lines

2. Position of boxes 6 and 7 was shifted up

3. Height for Boxes 6 and 7 was decreased from 4 lines to 3 lines

4. Position of boxes 8 and 9 was shifted up

5. Height for Boxes 8 and 9 was decreased from 4 lines to 3 lines

6. New box 10 Market discount was added

7. New box 11 Bond premium was added

8. 2013 Boxes 10, 11, 12, 13 are now 2014 Boxes 12, 13, 14, 15

9. Update 1099 fields

10. Should not need an upgrade since the previous 1099 boxes were not stored as 1099 fields

a. 1099 box INT-10 was updated to 1099 box INT-12

b. 1099 box INT-11 was updated to 1099 box INT-13

c. 1099 box INT-12 was updated to 1099 box INT-14

d. 1099 box INT-13 was updated to 1099 box INT-15

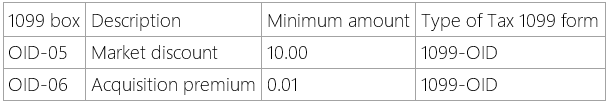

1099-OID

1.Box 5 was changed from Foreign tax paid to Market discount

2. Box 6 was changed from Foreign country or U.S. possession to Acquisition premium

3. Update 1099 fields

4. Upgrade 1099-OID transactions dated 1/1/2014 and forward for the following

a. Transactions with box OID-05 must have the 1099 box set to blank

b. Transactions with box OID-06 must have the 1099 box set to blank

1099-DIV

No change

Additional Changes

1. Functionality added to manually add 1099 amounts to account for non-cash compensation that would otherwise not be tracked in Dynamics AX.

2. Addressed an issue where only the SysAdmin role could edit 1099 fields in 1099 transactions form. An accounting user/manager role should also have access. (Also logged as Connect Suggestion 378229).

a. Create privilege Maintain vendor 1099s

i. Maintain security access for

a) Form Tax1099Summary

b) Form VendSettlementTax1099

b. Create duty Maintain vendor 1099s

i. Assign to Accounts payable manager and Accounting manager

3. Update E-mail (field) in the 1099 software vendor (form) – (Tax1099SoftwareVendParameters) http://technet.microsoft.com/en-us/library/aa584995.aspx