How to reverse a Fixed Asset disposal sale transaction

Fixed asset has two types of disposal transaction disposal sale, or disposal scrap. In this post I will focus on the disposal sale, this is accounting treatment in case of the company decided to sell a building, which is a fixed asset. The asset disposal sale transaction is executed from a customer free text invoice. In some scenarios the accountant may want to reverse the posted disposal sale transaction.

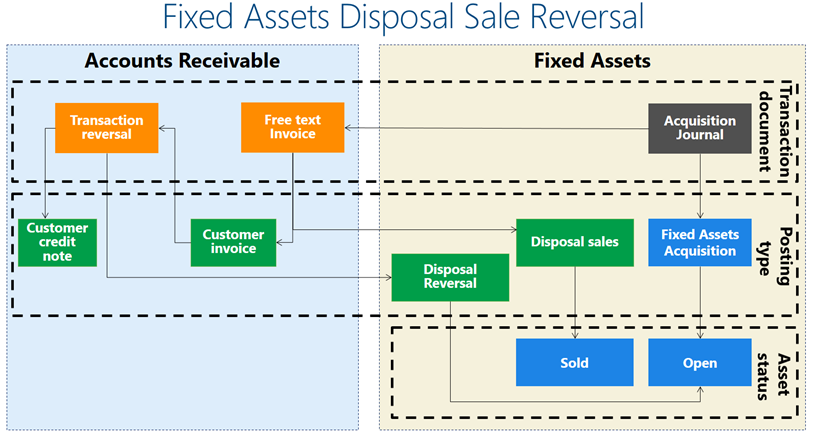

The following diagram illustrate a logical overview of the business process of fixed asset disposal sale to a customer. The cycle starts by acquiring a fixed asset in the fixed assets sub module, and this will result in the fixed asset status as open asset. Then move to accounts receivable sub module to execute the disposal sale transaction, this transaction is executed by the free text invoice. After posting the free text invoice the system generates two actions: –

- The first in AR submodule by posting a customer invoice.

- The second in fixed assets submodule by post disposal sale transaction and set status of fixed asset as sold.

The reversal of disposal sale is done from the accounts receivable submodule by using the reverse transaction functionality in the customer transactions form. This transaction has two effects, the first is to reverse the customer invoice, and the second to reverse the asset disposal entry in the fixed assets submodule. The asset status set to open as well.

Here I will show you how to execute this process in Microsoft Dynamics AX 2012.

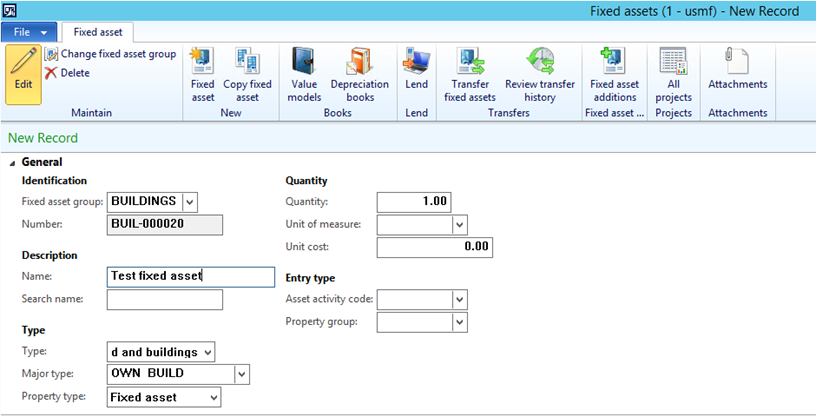

- Go to fixed asset| Common| Fixed assets| All fixed assets.

- Create a new asset record.

- Select asset group.

- Enter asset name.

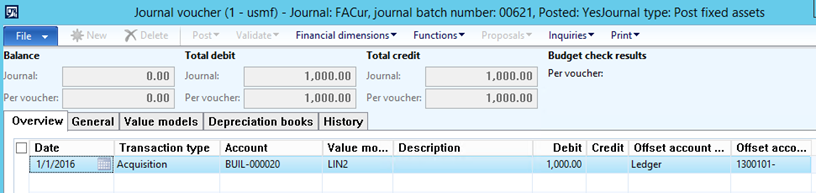

Acquire the newly created fixed asset by following the below steps.

- Go to Fixed assets| Journals| Fixed assets.

- Create a new journal.

- Enter the asset in the journal line.

- Post the acquisition entry.

In order to check the status of the fixed asset,

- Go to Fixed assets| Common| Fixed asset| All fixed assets.

- Filter on the asset number.

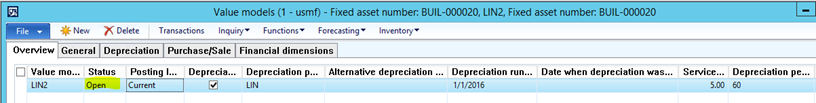

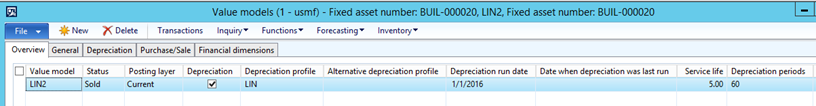

- Go to Value model in the ribbon. As shown in the below screen shot the asset status is Open.

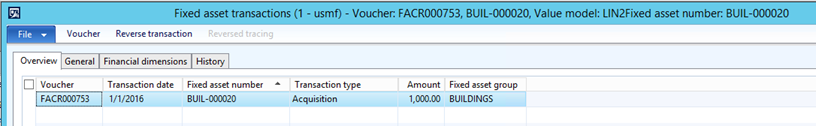

Select the transactions to show the posted asset transaction.

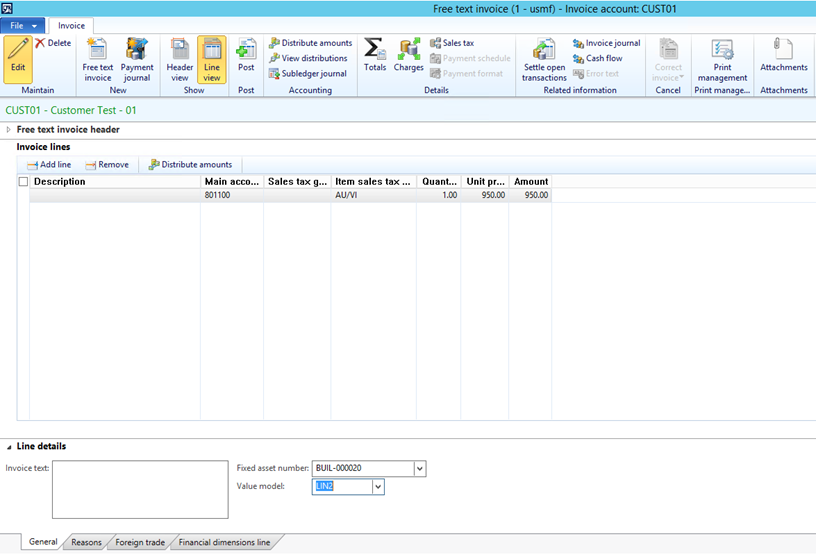

Create a Free text invoice to create a disposal sale of the asset. This is done by adding the Asset ID to the invoice line.

- Go to Accounts receivable| Common| Free text invoice| All free text invoice.

- Select customer ID.

- Move to invoice lines pane and select Main account.

- Enter unit price.

- Select Fixed asset ID.

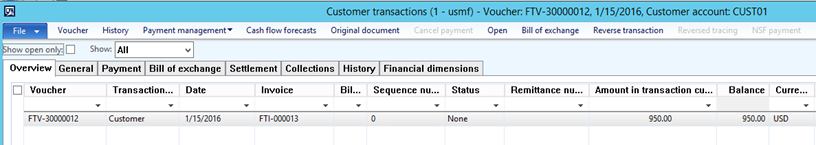

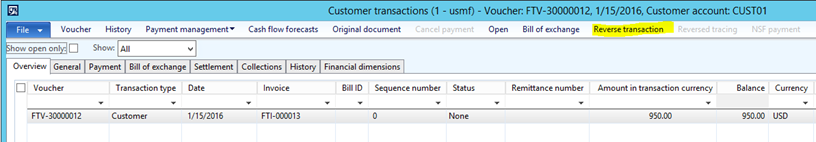

Check the customer transaction by following the below steps

- Go to Accounts receivable| Common| Customers| All customers.

- Filter to the customer which added to the free text invoice.

- Select transactions.

- Go to Fixed assets| Common| Fixed assets.

- Select fixed asset number.

- Select value mode. Here the status is changed to Sold.

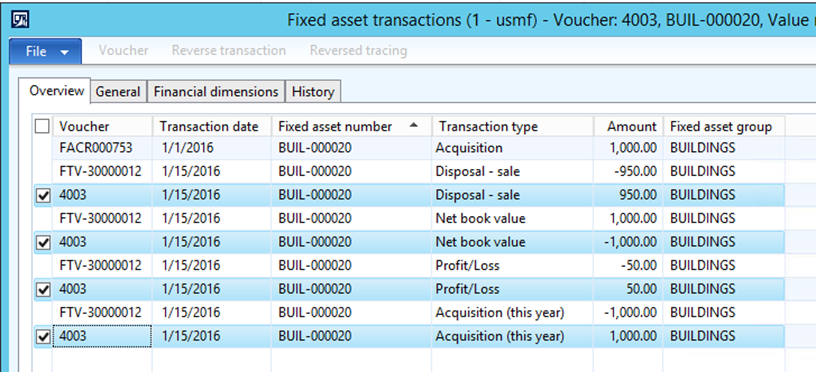

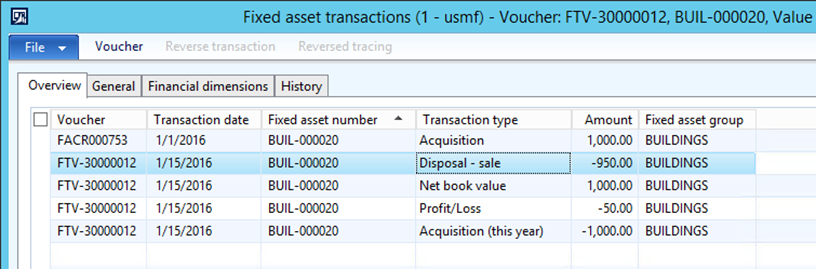

Select Transactions in order to show the posted disposal sale transaction.

To reverse the asset disposal transaction,

- Go to Accounts receivable| Common| Customers| All customers.

- Filter to the customer which added to the free text invoice.

- Select transactions.

- Click Reverse transaction.

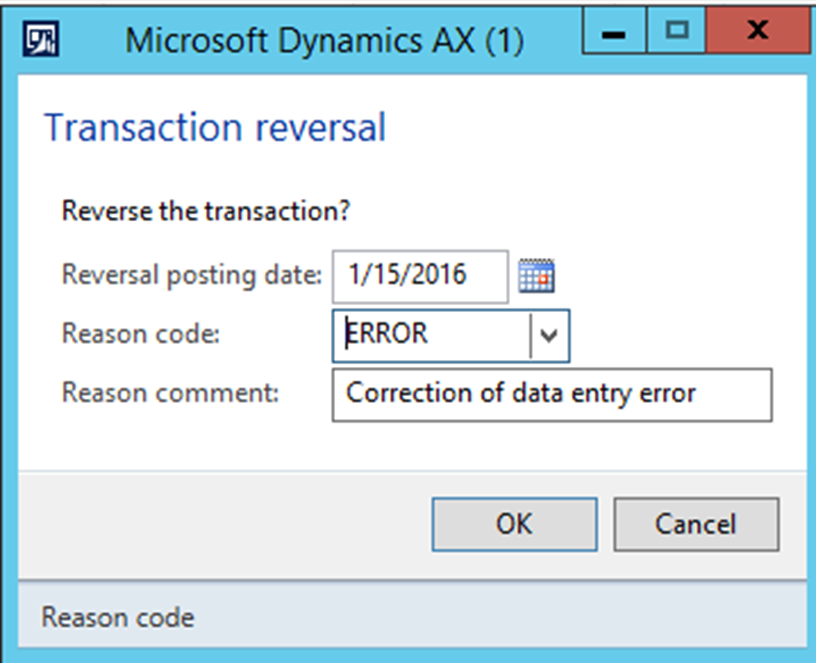

The transaction reversal dialogue box will pop up, enter a reversal date, reason code, and reason comment.

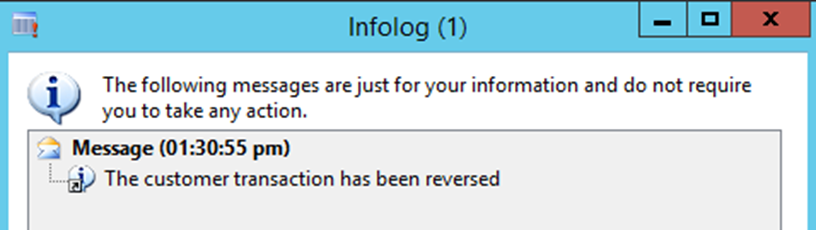

An Infolog will pop up which indicates the customer transaction has been reversed.

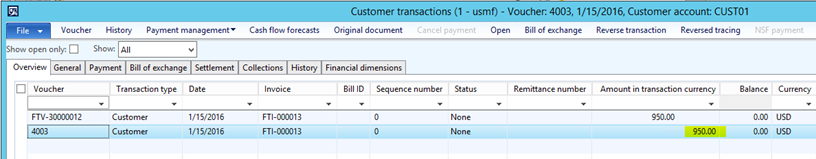

Check the posted reversal entry.

- Go to Accounts receivable| Common| Customers| All customers.

- Filter to the customer which added to the free text invoice.

- Select transactions.

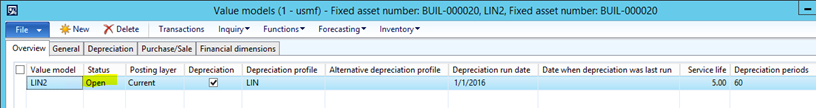

- Go to Fixed assets| Common| Fixed assets.

- Select fixed asset number.

- Select value mode. Here the status is changed back to Open.

Select Transactions in order to show the posted disposal sale reversal transaction.