Non-deductible VAT coming to Dynamics 365 Business Central worldwide

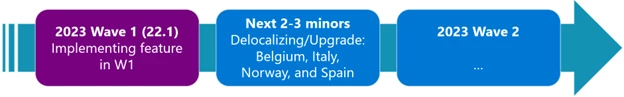

You asked for it and we’re delivering: With 2023 release wave 1, Microsoft Dynamics 365 Business Central will expand the non-deductible value-added tax (VAT) feature to our customers worldwide. It’s required by almost all countries where VAT is used and was previously available only to our customers in Belgium, Italy, and Norway. We’re excited to make it available everywhere our Business Central customers are.

VAT is a tax that businesses must pay when they buy things. They can usually recover the tax by buying goods and services relating to their business activities. However, there are some situations in which a business incurs VAT that can’t be recovered and isn’t deductible.

The expanded functionality covers the most common scenarios and can be easily extended if you need more features.

Non-deductible VAT options

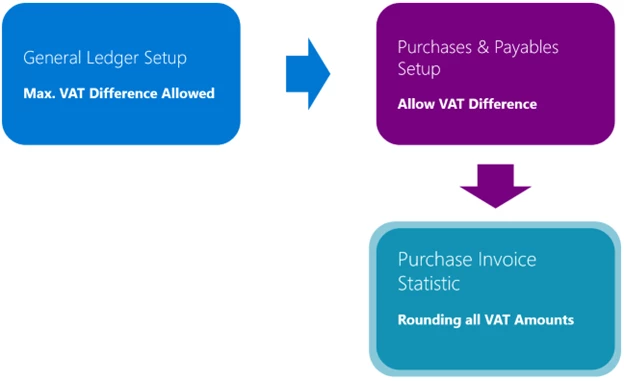

You can use proportional VAT to calculate VAT when you have both deductible and non-deductible VAT. Non-deductible VAT is included in purchase documents only. Depending on your settings, you can use fully or partly non-deductible VAT or a combination with different deductible percentages per line. You can use it configured as Normal VAT, Full VAT, and Reverse Charge VAT with or without deferrals. Before posting the purchase document, you can adjust the VAT amounts if VAT rounding in the external system and Business Central differ.

Reporting non-deductible VAT

After posting, the VAT Entry table shows separate details for deductible and non-deductible amounts and bases. When it’s time to report VAT amounts to your authorities, the Amount Type column in the VAT Statements view offers options for non-deductible and full amount or base. The Day Book VAT Entry report features new columns as well. Other reports will be updated in later releases based on our customers’ feedback.

Setting up to use non-deductible VAT

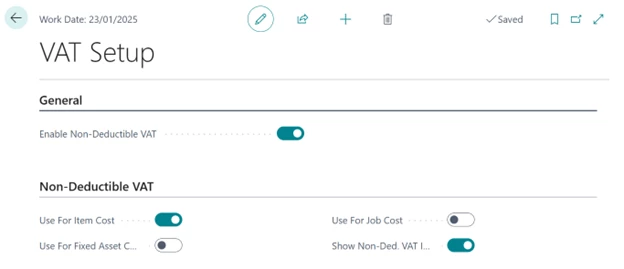

Non-deductible VAT is included in the base application but isn’t enabled by default. To use this feature, you must enable it on the VAT Setup page.

After enabling the feature, configure VAT posting group combinations for use as non-deductible VAT. Enable them and add a percentage for deduction.

If needed, you can fine-tune the settings for better results. You can choose to configure the impact of non-deductible VAT on the item cost, fixed asset acquisition cost, or job cost. You can also configure how to treat non-deductible amounts. If you want these amounts to be posted only in General Ledger entries but use them as an additional cost in purchase, you can add it in the setup.

We added all the non-deductible VAT logic and events to the Non-Deductible VAT Management codeunit. If you need to get the non-deductible VAT percentage not just from the VAT posting setup, use the OnBeforeGetNonDeductibleVATPctForPurchLine integration event and return the Non-Deductible VAT % based on the purchase line.

Deprecating existing functionalities

As part of expanding the non-deductible VAT feature worldwide, we’re deprecating the specific solutions for Belgium, Italy, and Norway starting with Business Central 2023 release wave 2 (version 23). You’ll have three releases after version 23 to adjust your extensions to the W1 solution.

Non-deductible VAT will be available in May with 2023 release wave 2 for all countries/regions using the W1 base app and all countries/regions using local base apps other than Belgium, Italy, Norway, and Spain.

Next steps

If you see some obstacles in this process, please get in touch with us. The best channel for communication is our Yammer group for partners, https://aka.ms/BCYammer (requires partner credentials to log in).

To learn more, watch the on-demand session “What’s new: Non-deductible and partly deductible VAT” at the latest Business Central launch event. Register and watch here: https://aka.ms/BCLE.

Not yet a Dynamics 365 Business Central customer? Take a tour and get a free trial.