Optimizing financial processes and reducing risk with Dynamics 365 Finance updates

From managing invoicing to maintaining regulatory compliance, finance is often filled with costly, time consuming, and error-prone manual processes. These challenges are exacerbated in times of uncertainty and continue to impact organizations globally.

The 2020 release wave 2 updates for Microsoft Dynamics 365 Finance bring additional core functional capabilities, opportunities to automate common processes, and improved global support. Together, these enhancements will help finance organizations prioritize impactful work, build efficiency and agility into their financial processes, and support global growth—all while staying compliant with changing accounting regulations.

Below are the key focus areas for the 2020 release wave 2 including, notable partnerships and capability updates.

Optimize financial operations

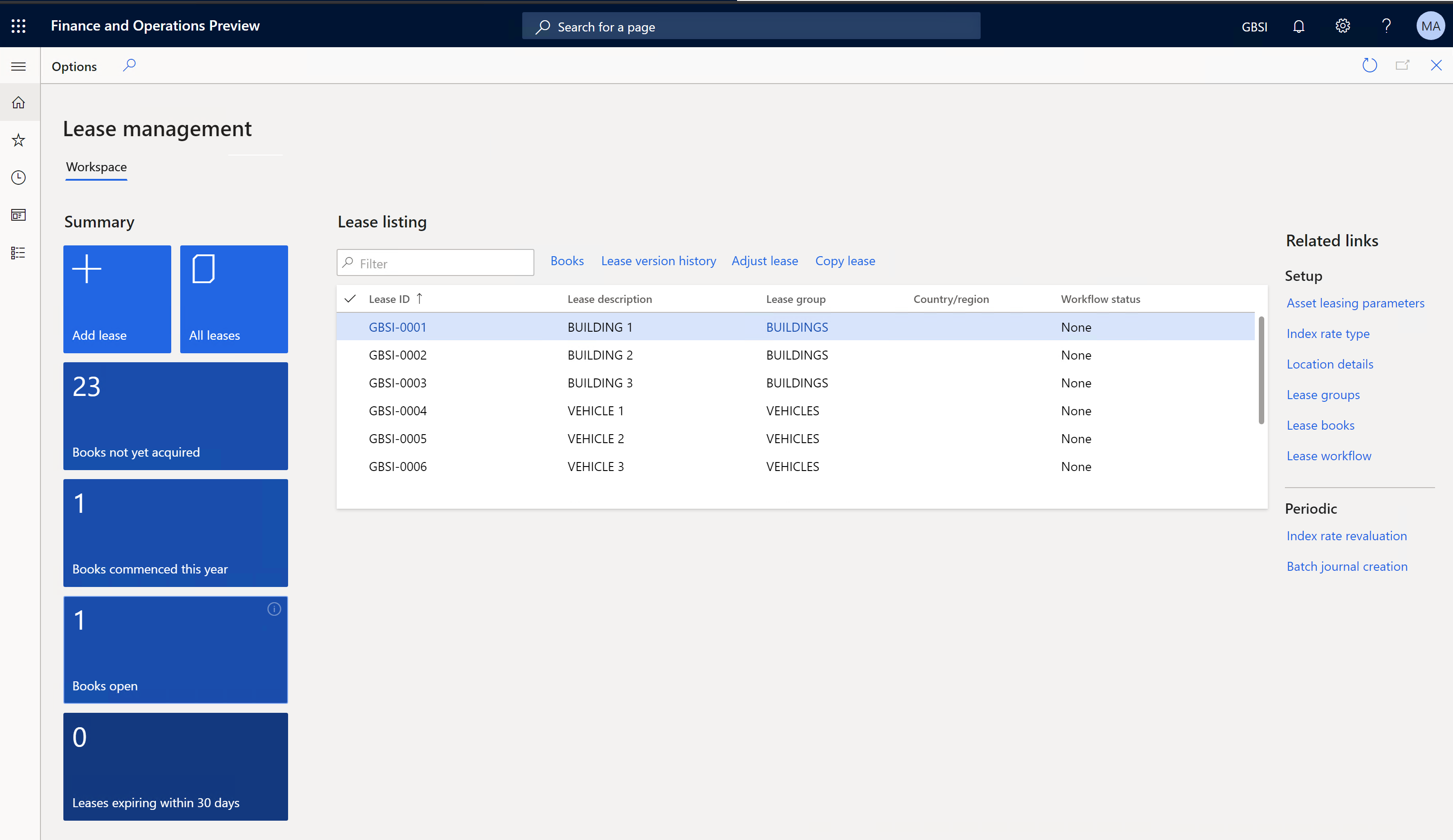

Simplifying and automating compliance with asset leasing

Today most organizations are experiencing challenges and making plans that they did not anticipate. In times like these, organizations do not have time to worry about reacting to changes in accounting regulations, yet they cannot risk leaving them unaddressed.

A core tenant of Dynamics 365 Finance is to enable you to reduce risk, and to automate and modernize your global financial operations. To help you achieve this, we are introducing asset leasing in November 2020. Asset leasing helps you adapt and be compliant to the FASB and IFRS 16 accounting regulations, related to lease management and its financial impact. Asset leasing will reduce manual errors and save your users time through automatic lease status updates, right of use assets, holistic monitoring and analytics, and calculations of net present value, lease interest, and future cash payments.

Bringing world class, enterprise treasury management to Dynamics 365 Finance

Treasury management is key for customers to plan, organize, and control cash and liquidity within the organization. This entails managing multiple bank accounts, liquidity, borrowings, and general bank interactions using non-integrated systems. Combining these views into a centralized view mitigates risk by providing a single source to manage financial matters and interact with bank systems.

To address this important need, Dynamics 365 Finance and Kyriba, the global leader in cloud treasury solutions, have entered a strategic partnership to give Microsoft Dynamics 365 customers better visibility into their cash, currency hedging, fraud reduction, and payment solutions.

- The treasury management solution provides visibility and reporting needed to optimize cash and liquidity, control bank accounts, deliver compliance, and manage in-house banking.

- Streamline global banking connectivity and format transformation and enable real-time fraud detection with the payments solution.

- The risk management solution uses extensive business intelligence capabilities to identify, analyze, and mitigate foreign exchange risks.

- The working capital solution focuses on improving free cash flow and improving EBITDA working capital. This analysis aids in extending payment terms and enables better working capital management.

Working together, Kyriba and Dynamics 365 Finance have identified out of the box integration capabilities to quickly allow customers to take advantage of the rich capabilities of Kyriba, while having Dynamics 365 Finance as their intelligent, automated system of record for core finance.

Begin using Kyriba’s payment solution integrated with Dynamics 365 Finance today with pre-built startup scenarios based on native payment processing functionality including:

- Vendor payments and third-party transfers to flow through Kyriba Payments Network.

- Pre-built bank connectivity—more than 45,000 bank payment scenarios for more than 1,000 banks.

- Standardize digital payment transformation to enhance visibility and straight through payment processing.

- Payment status updates returned from the bank directly into Dynamics 365. Status’ include:

- Initial retrieval of payment transactions by Kyriba.

- Update of final bank transaction status to payment journals.

- Tracking details required to link and monitor process status in Kyriba.

- Visibility of Kyriba processed payment transactions from screens showing information about in-process and final status details.

Learn more about Kyriba Payments Network for Dynamics 365.

Protecting your revenue

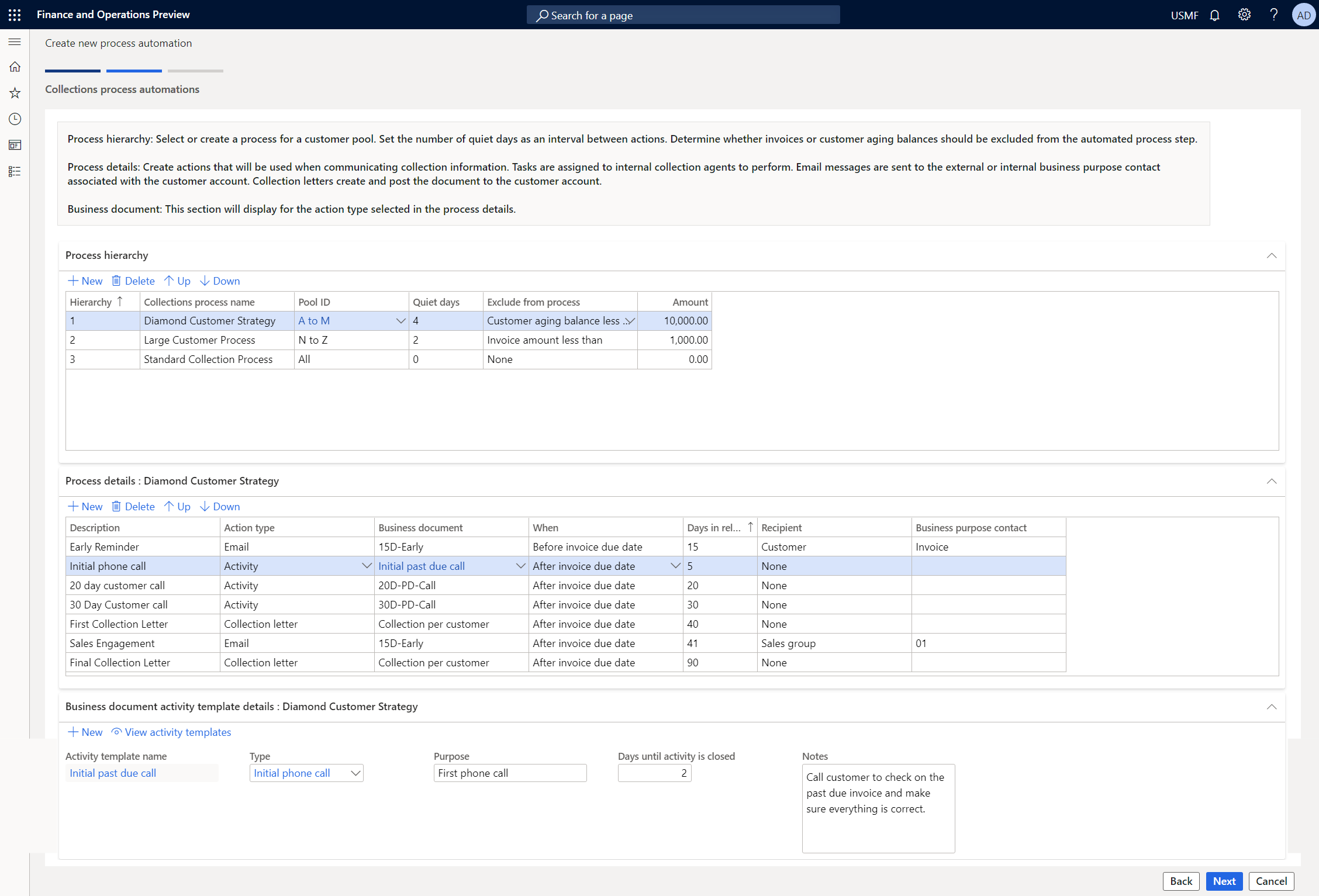

Capturing revenue and avoiding missed or late customer payments is essential in the current market environment. The following capabilities are focused on expediting processes and focusing on results related to credit and collections.

- Automatic collection task creation: Create a rule-based collection strategy using invoice attributes such as payment predictions, due dates, and amounts to automatically create tasks and email reminders. This increases the likelihood of on-time payments, improves incoming cash flow, and saves collections agents’ time—enabling them to focus on high value activities.

- Touch-less email reminders: With the intention to minimize late and missed payments, when enabled, email reminders will be sent automatically to customers with a list containing overdue invoice information.

Adapt quickly and reduce costs

Operational complexity and risk continue to intensify as organizations grow globally and expand their footprints across regions. Maintaining compliance and adapting to frequently changing regulations is a growing challenge. The following updates are intended to alleviate challenges related to some of the most manual, time-consuming, and error-prone processes in finance.

- Vendor invoice automation: Save time and reduce labor costs by enabling straight-through, touchless invoice processing. Leverage metrics and analytics on results which provide visibility into the invoice processes’ status, highlight errors, and allow accounts payable clerks to find and address issues quickly.

- Expanded localizations: Out-of-the-box, country- or region-specific functionality has been expanded to 42 countries and regions to include Bahrain, Hong Kong SAR, Kuwait, Oman, and Qatar. We also have more than 40 ISV localization solutions at AppSource.

- Electronic Invoicing add-on for Dynamics 365: Organizations have begun to move away from paper invoices to reduce costs and speed up the end-to-end process. Moreover, governments are increasingly turning to electronic invoicing as a key component of tax digitalization. By requiring organizations to digitally submit real-time tax information to tax authorities, governments can minimize tax evasion and manipulation, and reduce fraud. The world is shifting to paperless document processing and, without implementing electronic invoicing, customers’ risk compliance issues, unnecessary costs, and lagging behind competitors.

The Electronic Invoicing add-on extends the electronic invoicing capabilities in Dynamics 365 Finance, Microsoft Dynamics 365 Supply Chain Management, and Microsoft Dynamics 365 Project Operations simplifies adherence to the newest electronic invoicing standards and provides coherent experiences for different geographies in electronic invoice processing and exchange.

Explore all of the release wave 2 updates for Dynamics 365 Finance

With the new capabilities offered in the 2020 release wave 2, we continue to enable customers to optimize financial operations, protect their revenue, adapt quickly, and reduce costs. If you’re interested in learning more, take a look at the full rundown of updates for Dynamics 365 Finance.